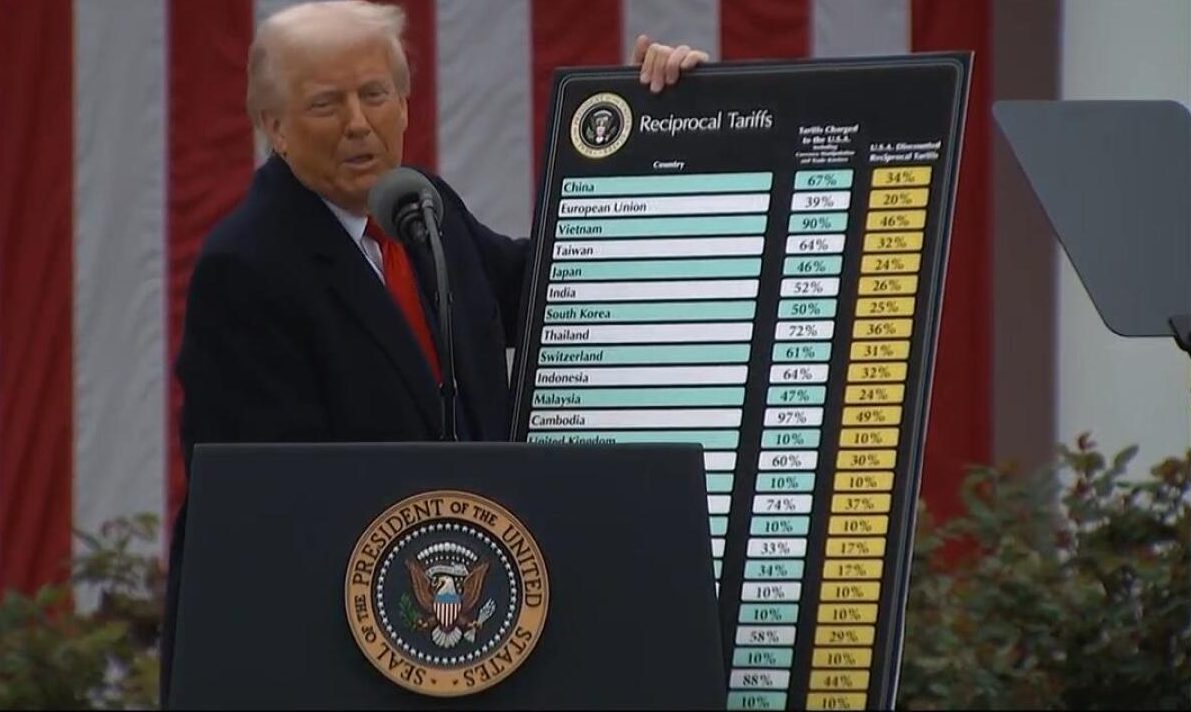

On April 2, 2025, President Donald Trump delivered a speech in the White House Rose Garden, declaring the day “Liberation Day” for America as he unveiled a bold new trade policy centered on tariffs. In his address, Trump introduced a 10% baseline tariff on all imports, effective April 5, alongside significantly higher “reciprocal tariffs” targeting countries with large trade surpluses, such as a 34% tariff on China and 20% on the European Union, set to begin April 9. He positioned these measures as a historic step to reclaim America’s economic sovereignty, boost domestic manufacturing, and correct what he described as a “national emergency” caused by persistent trade deficits.

Trump emphasized that the U.S. has been unfairly burdened by higher tariffs from other nations compared to what it imposes. For example, he highlighted that the European Union charges a 50% tariff on American dairy, Japan levies a 700% tariff on U.S. rice, India imposes a 100% tariff on American agricultural products, and Canada applies a 300% tariff on U.S. butter and cheese. In contrast, U.S. tariffs on these countries have historically been much lower—averaging around 2-3% under Most Favored Nation (MFN) rates—or even zero with Free Trade Agreement (FTA) partners like Canada under the USMCA. Even with non-FTA nations like China, U.S. tariffs prior to this policy were modest compared to the 67% China imposes on American goods, including currency manipulation and trade barriers. Trump’s reciprocal tariffs, set at roughly half the rates other countries charge the U.S. (e.g., China’s 67% met with 34%, India’s 52% with 26%), aim to level the playing field. He stated, “April 2, 2025, will forever be remembered as the day American industry was reborn,” promising a “golden age” of prosperity despite concerns from economists about inflation and potential trade wars.

As a result of these tariff policies, several major companies have announced commitments to bring or expand their manufacturing plants in the United States. Hyundai Motor Group pledged a $20 billion investment, including $5.8 billion for a new steel manufacturing facility in Donaldsonville, Louisiana, to bolster its North American production. Stellantis committed $5 billion to its U.S. manufacturing network, including reopening an assembly plant in Belvidere, Illinois, to increase domestic vehicle production. Eli Lilly and Company announced a $27 billion investment in U.S.-based manufacturing to enhance its pharmaceutical production capacity. Clarios, a leader in low-voltage energy storage, revealed a $6 billion plan to expand its U.S. manufacturing operations. GE Aerospace committed $1 billion across 16 states, creating 5,000 new jobs in its U.S. manufacturing facilities. Prepac, a Canadian furniture manufacturer, announced it will shift production from Canada to the U.S. Nissan is expected to relocate production from overseas factories to the U.S., while Volkswagen is considering moving production of its high-end Audi and Porsche brands to American soil. These moves signal a significant response to Trump’s tariff strategy, aimed at incentivizing domestic production.

In conclusion, these tariffs are poised to bolster American goods, services, and jobs by making imported products less competitive, encouraging consumers and businesses to buy American-made alternatives. By shielding domestic industries from low-cost foreign competition, the policy aims to revitalize manufacturing hubs, increase demand for U.S.-produced goods like steel, machinery, and agricultural products, and create a ripple effect of job growth in sectors from farming to technology. Trump’s vision is that this shift will not only protect existing jobs but also spark new opportunities, driving investment in American innovation and workforce development, ultimately strengthening the nation’s economic foundation for years to come.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link